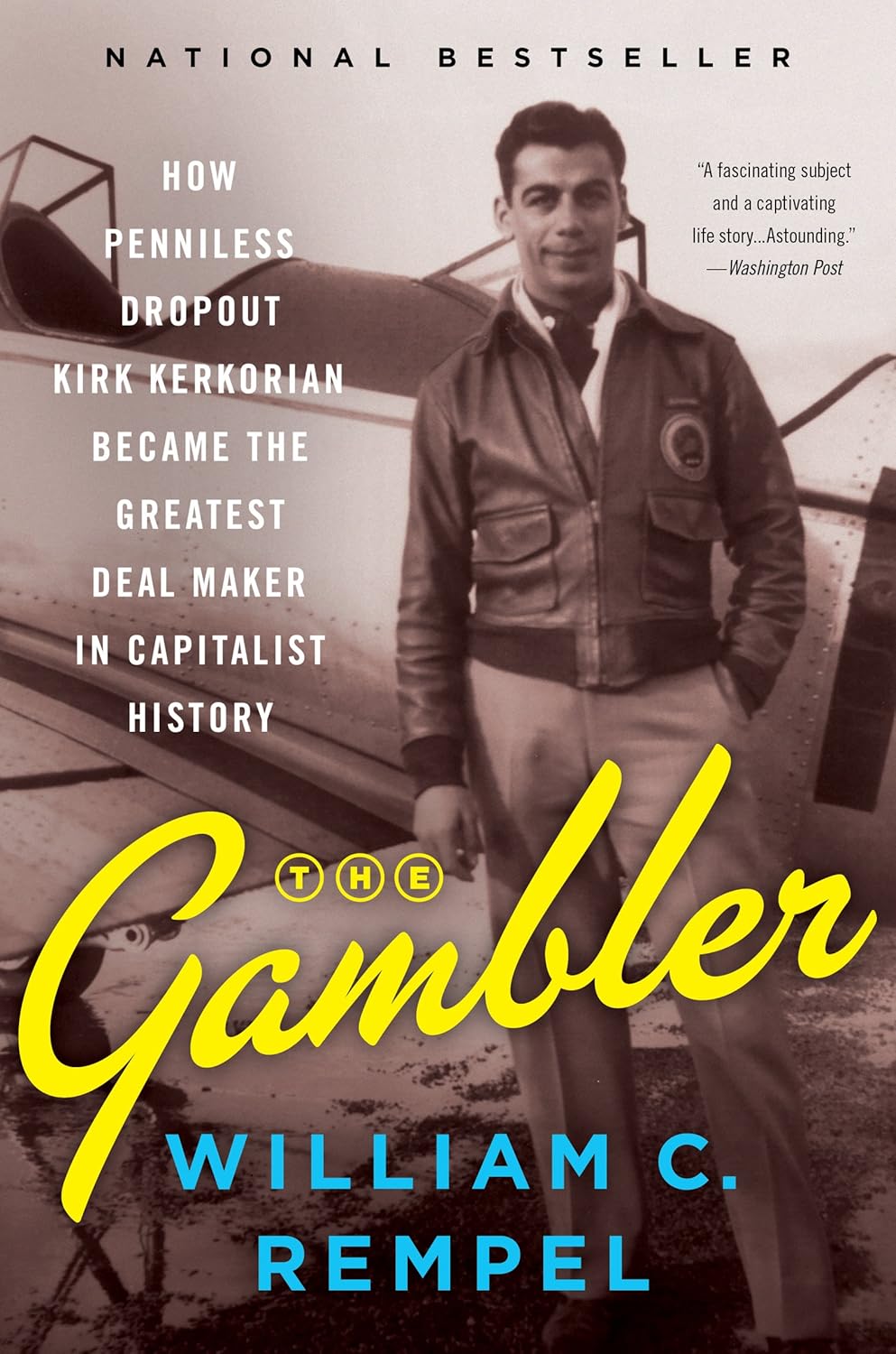

Kirk Kerkorian Part 2: From Aviation Mogul to Investor

Kirk Kerkorian’s charter airline, Trans International Airlines (TIA), was doing well—so well that in 1962, Studebaker Corporation offered to acquire it by assuming all Kirk’s debt and giving him $1 million in Studebaker stock, for a total deal value of $10 million. Kirk agreed and became a millionaire.

Kirk's biography says Studebaker fell on hard times and sold TIA back to Kirk two years later, in 1964, for just $2.5 million. He borrowed $2 million from Bank of America and closed the deal. By now having a better understanding of the stock market, Kirk took TIA public in 1965. As the company’s performance improved and the Armenian community supported the stock, it soared. In a few months, Kirk paid off the bank loan and owned stock worth $66 million at the age of 48. Three years later, in 1968, he sold TIA to Transamerica Corporation in a deal that gave him $100 million in Transamerica stock.

To recap, Kirk started his first flight school and charter company around 1945. Roughly twenty years later, he’d turned that idea into a publicly traded company in which he had a personal ownership worth $66 million. Three years later, he was Transamerica Corporation’s largest individual shareholder with ownership exceeding $100 million. That’s a remarkable accomplishment, especially considering his humble beginnings.

During this period, Kirk evolved. He transitioned away from being solely a hands-on aviation operator and builder, learning and acquiring skills around mergers and acquisitions and navigating the stock market. He used those skills to add public market investing to his resume. Kirk was no longer just an aviation entrepreneur.

His ability to level up stood out to me, especially considering that the above was only part of what he juggled during this period. He was also beginning to acquire land and consider entering the casino market.

Prefer listening? Catch audio versions of these blog posts, with more context added, on Apple Podcasts here or Spotify here!