The Newhouse Family Compounded Wealth by Optimizing Taxes

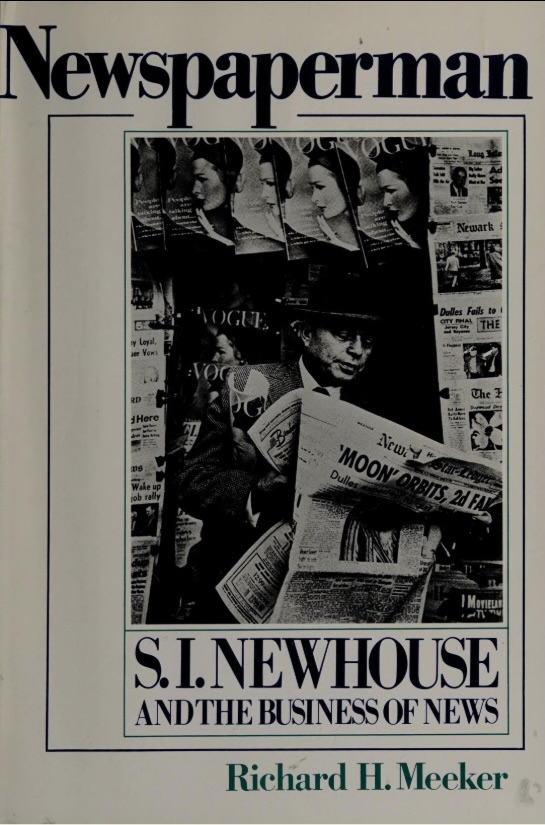

I finished reading Newspaperman: S.I. Newhouse and the Business of News by Richard H. Meeker. The biography is about Samuel Irving Newhouse Sr., who founded Advance Publications. At Sr.’s death, Advance Publications owned multiple newspapers and Condé Nast, which publishes famous magazines such as Vogue, Vanity Fair, GQ, and The New Yorker. Since then the company has grown rapidly, and it owned 26.5% of Reddit when Reddit began trading on the public stock market this year (see here, page 194). Reddit’s market capitalization (i.e., valuation) is just under $12 billion as of this writing.

This book and Newhouse: All the Glitter, Power, & Glory of America's Richest Media Empire & the Secretive Man Behind It by Thomas Maier detail one key strategy the Newhouse family used to grow their wealth: they optimized their tax liability and maximized the compounding of their wealth. The family studied the tax laws and implemented strategies that reduced their tax liability. This gave them more capital to reinvest in growing their companies or acquiring new companies.

Both books contain numerous examples. Their estate tax strategy especially caught my attention. When someone dies, their estate is transferred to heirs and a tax is due on the value of the estate being transferred if it exceeds that year’s federal threshold. When Sr. died in 1979, his sons filed a return valuing his ownership in Advance Publications at roughly $182 million and showing an estate tax due of roughly $49 million. The IRS said his estate was worth somewhere between $1 billion and $2 billion and that the estate tax due was, at a minimum, $600 million, and as high as $1.2 billion. At the time, Advance Publication owned thirty newspapers and various magazines. Its two most prosperous newspaper properties alone were worth more than $182 million.

Sr. had studied other publishing families to understand how death and estate taxes negatively impacted their family empires. Families often had to sell all or some of the company’s assets to pay the estate tax upon the founder’s death. Sr. developed a dual-share-class strategy to avoid that outcome. Sr. owned common shares in Advance Publications but issued preferred shares to his siblings, wife, and sons. His common shares carried voting rights and, essentially, control of company decision-making, but the preferred shares gave holders the right to vote on a company liquidation or sale. Said differently, if a buyer wanted control of the company, the buyer had to get the approval of the preferred shareholders first. The result was a gray area in the tax law. It could be argued that the fair market value of the company—the price a willing buyer and seller would transact at—was significantly lower than the IRS’s figure because there would be fewer buyers willing to buy a minority stake in a family-owned company that had such a bizarre ownership structure. Most buyers spending that kind of money would want majority ownership so they could have control. To gain control, they’d have to convince multiple family members to sell, a prospect many buyers would rather avoid. There’s more to this, but that’s the gist of it.

The IRS took the family to court, and the family prevailed. The result was that the family paid an estate tax bill that was a fraction of what it would have been if Sr. hadn’t planned so carefully. It wasn’t a material amount for the company, so it didn’t have to sell any assets to pay the tax. The Newhouse family’s empire could continue compounding for another generation and grow exponentially under Samuel “Si” Newhouse Jr.’s leadership for the next forty years.