Learning from the Masters of Capital Allocation

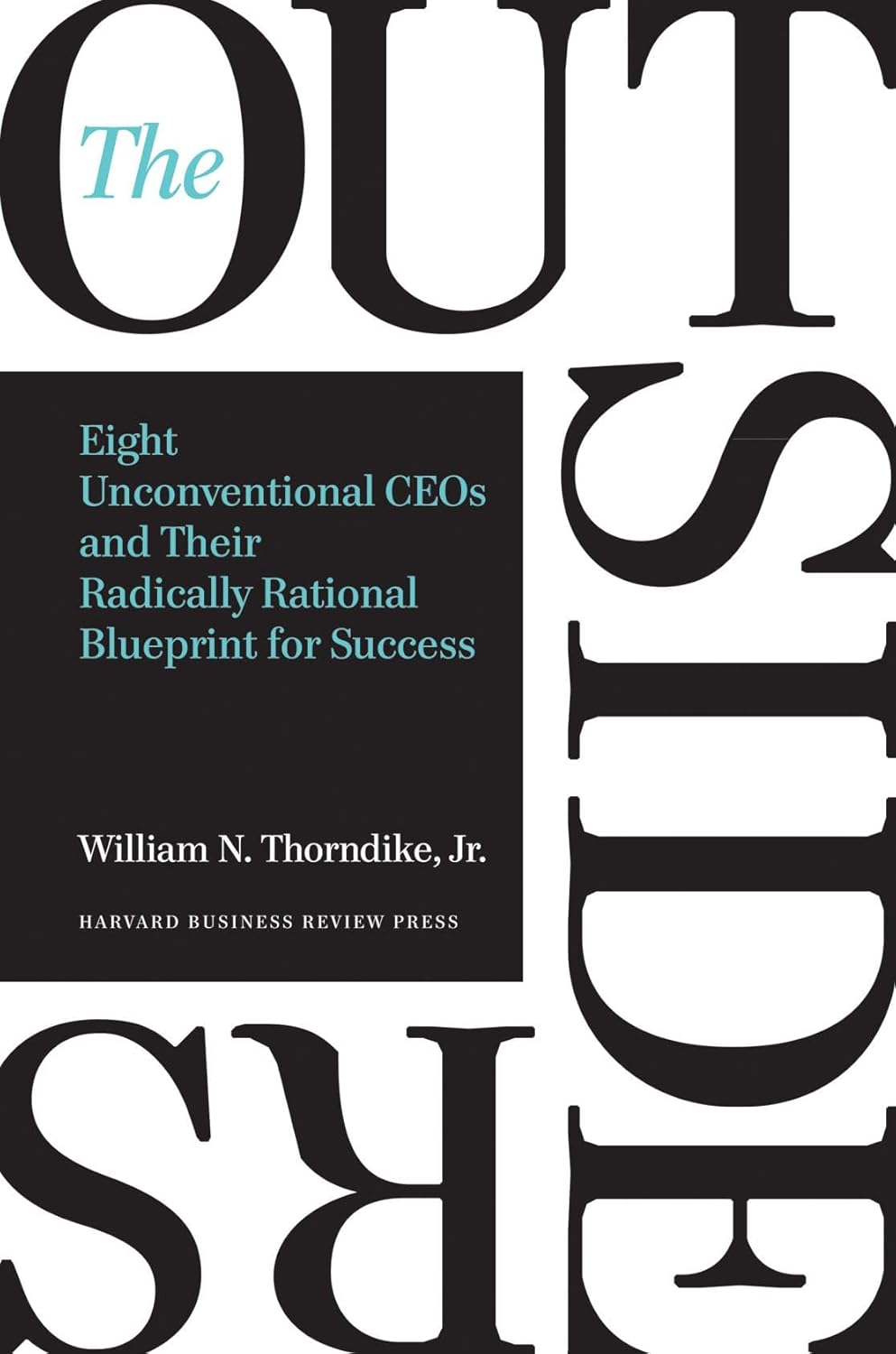

Today I finished reading The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success. William N. Thorndike, Jr. profiled these CEOs:

- Tom Murphy, Capital Cities Broadcasting

- Henry Singleton, Teledyne

- Bill Anders, General Dynamics

- John Malone, TCI

- Katharine Graham, The Washington Post

- Bill Stiritz, Ralston Purina

- Dick Smith, General Cinema

- Warren Buffett, Berkshire Hathaway

The book describes how CEOs generated capital and executed creative approaches to capital allocation, and it reports their returns over a long period. I was familiar with Buffett but less so with the others. I took many notes on Murphy, Singleton, Malone, and Graham.

It was interesting to learn about Singleton’s strategy. It was the same as Buffett’s playbook, and Singleton was older than Buffett and deployed his strategies before Buffett did. Buffett has praised Singleton as one of the best businessmen ever, and I’d imagine many strategies that make Berkshire Hathaway successful were borrowed from Singleton’s playbook.

John Malone is the CEO I’m most unfamiliar with and most excited to learn more about. Malone recognized the predictability and high growth rate of the cable industry early. He used various strategies to build one of the largest cable distribution companies. He also helped seed various cable programming entrepreneurs, such as Bob Johnson of BET, and partnered with other cable entrepreneurs, including Ted Turner.

This book chronicles CEOs of publicly traded companies, so most examples don’t apply to early-stage entrepreneurs. But it does a good job of explaining capital allocation, including why it’s the most important job of a CEO, and quantifying the results of superior capital allocation by talented CEOs.

Capital allocation is a mindset and a skill all entrepreneurs should be aware of. For entrepreneurs seeking to grow their companies, capital allocation is a critical skill to master.