Roy Thomson Part 6: The Conclusion

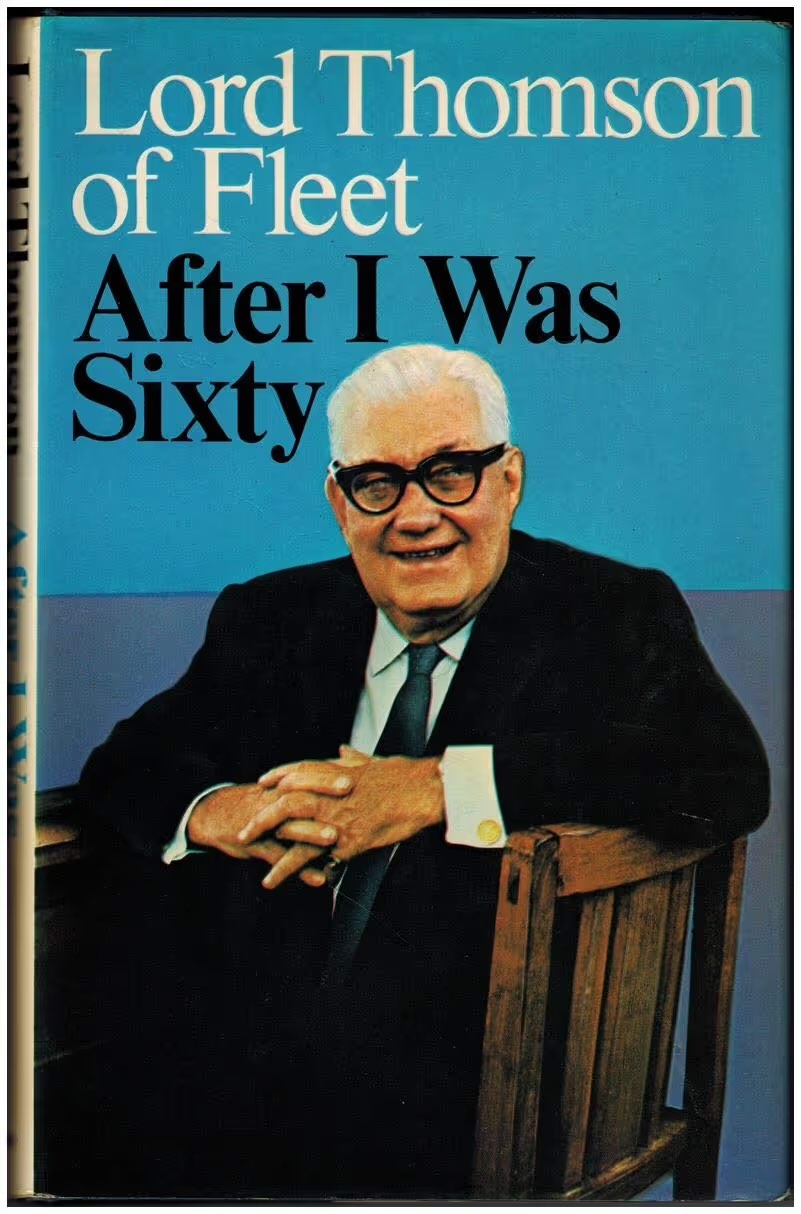

I’ve finished reading a biography of Roy Thomson’s journey. It was written in 1965 when Roy was around 71. Roy lived another eleven years. In 1976, he wrote an autobiography that focused on the building of his British empire. I plan to read it.

How Did Roy’s Early Years Affect His Trajectory?

Roy’s parents were working class; his father was a barber, and his mother was a maid at a hotel. Roy’s great aunt, Sarah Hislop, was not working class. She invested in mortgages, and she held the mortgage on the home Roy’s parents owned. Given the family’s limited means, paying off that mortgage was their highest priority. This dynamic contributed to Roy needing to work as early as legally permissible and dropping out of school at age 14 to work full-time. The contrast between Aunt Sarah and Roy’s parents made an impression on Roy. His parents were working to scrape together enough money to pay Aunt Sarah. Aunt Sarah’s loan generated income for her, regardless of whether she worked. Roy’s parents worked for money, and Aunt Sarah’s money worked for her. Roy wanted the latter. Like Aunt Sarah, he wanted to be wealthy, and he developed a “passionate devotion to money.”

Aunt Sarah noticed his respect for money and loaned 15-year-old Roy capital to invest in mortgages alongside her. Roy was instantly hooked—hooked on the notion that he could borrow money to purchase investments and buy things that would generate cash in the future.

Roy told coworkers he’d be a millionaire by age 30. He didn’t achieve that goal, but becoming wealthy became the driving force in his life.

What Strategy Did Roy Employ to Achieve Success?

Roy learned that selling physical products and scaling that business model is complex. To sell more products, you need more inventory; to buy more inventory, you need capital to purchase it and, sometimes, expand your capability to store it.

Roy created a radio station as a way to sell more radios but quickly learned it was much easier to increase revenue in a radio station than in a company selling radios. The more listeners tuned in, the more people the ads reached and the more Roy could charge for advertising. He realized that radio broadcasting as a business model had leverage because his costs remained the same as listeners and ad revenue increased. The cost of marginal replication was low or zero, and revenue increases could happen rapidly. This was true for television broadcasting and newspapers too, which he expanded into. Media became the backbone of Roy’s strategy. Whether his customers were reading newspapers, listening to radio, or watching TV, Roy could sell their attention to advertisers for a profit.

Starting a radio station, television station, or newspaper from scratch is hard and takes time. Roy started off doing this but realized he preferred to improve existing properties. An underperforming property could be acquired for a low multiple (i.e., low price), especially if it was in a rural town and had been family-owned for generations. Once it was improved and benefiting from the economies of scale by being part of his empire, it could rapidly produce more cash. Buying media properties, improving operations, and generating cash became vital to Roy’s strategy.

Roy said, “My fortune is as large as my credit rating . . . and my credit rating is limitless.” This pretty much sums up the next part of Roy’s strategy. He believed in using debt, a form of capital leverage, to obtain the capital needed to acquire media properties. He understood two things about debt:

- Rate of return – Roy used borrowed money when the potential rate of return exceeded his interest rate. For example, when he could borrow money at 5% and buy an asset that in a year would generate a cash return of at least 10% of the purchase price, buying that asset with debt made sense.

- Ownership – Roy was focused on the companies he acquired generating cash years into the future. He didn’t give up ownership in his companies when he used debt, which meant he owned those future cash flow streams (after the debt was paid off). If he’d raised capital by selling equity (i.e., ownership), other investors would own part of those future cash flow streams in perpetuity.

Another thing that stood out to me was how Roy used two forms of leverage. He combined a highly scalable media business model (low to no cost of marginal replication) with capital leverage (debt). The combination of the two, along with luck and a focus on cash flow, turbocharged his ability to build his empire and wealth.

What about Roy’s Execution Made Him Successful?

Roy eventually learned to stay out of the details and focus on strategy and acquisitions. Like many entrepreneurs, he learned this the hard way. After years of being in the weeds, he hired Jack Kent Cooke, who freed him up. He learned his company could move faster with him out of the details. From that point on, he ran a decentralized company with nonfinancial decision-making at each media property that aligned with the community being served. Henry Singleton at Teledyne and Warren Buffett at Berkshire Hathaway used similar approaches.

Roy also put a ton of hours into his work. He was known to work sixteen- and seventeen-hour days and sometimes wouldn’t see his family until the weekend. He got more done than the average person. Working that much had a downside, though. When his wife passed away, he regretted not spending more time with her.

Roy’s story was inspiring. He failed for many years, first as a farmer, then selling automotive parts, and then as an electronics retailer, before realizing the power of media. But when he figured it out, he excelled. He built an empire that still stands today.