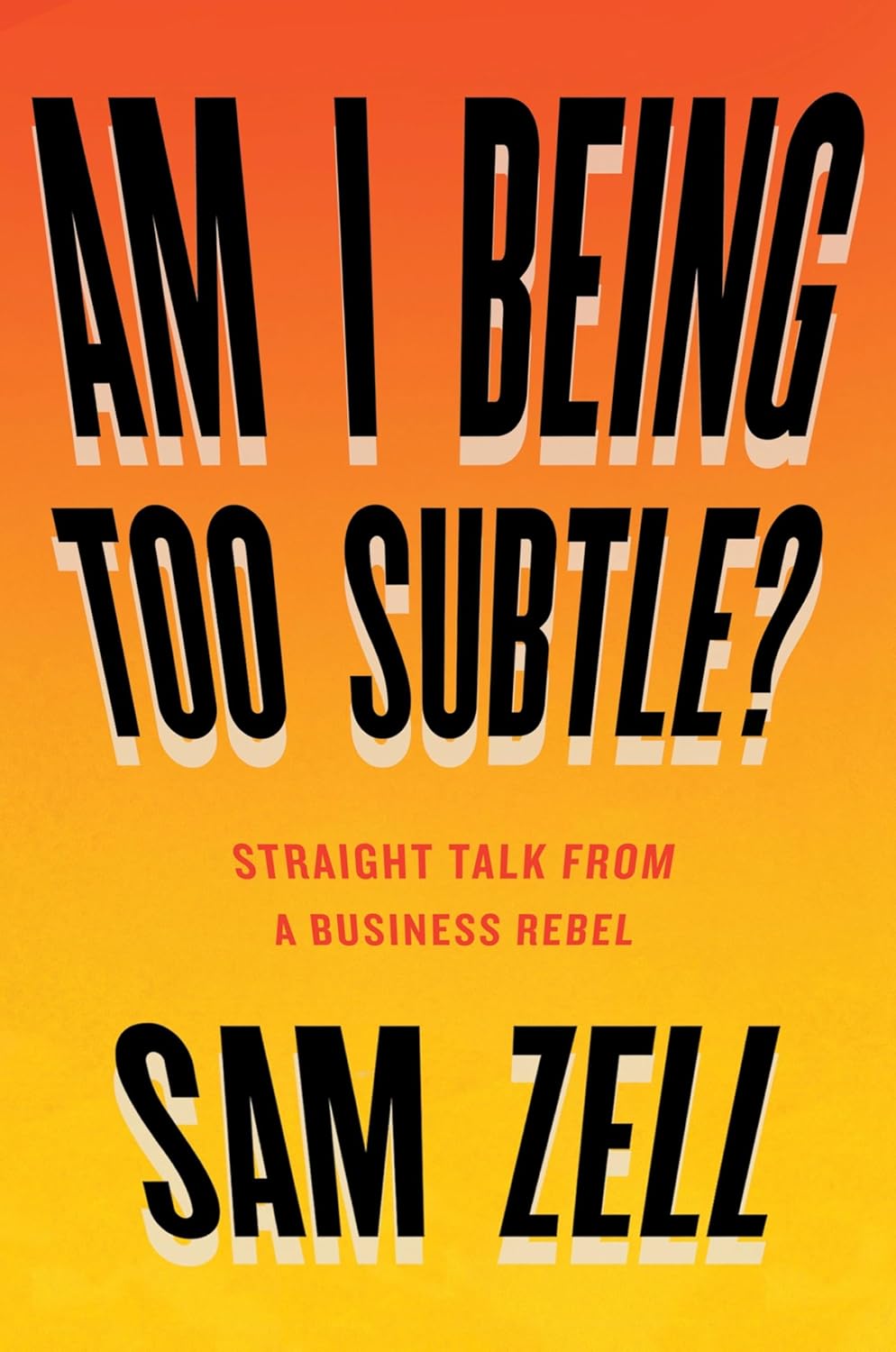

Sam Zell Part 5: The Wrap-up

I finished reading about Sam Zell’s journey. Sam was a colorful person, and his autobiography captures this. He published this book in 2017, when he was 75, and passed away last year at age 81.

What Was Unique about Sam’s Upbringing?

Sam grew up in a middle-class family, but his upbringing was unusual. His parents left Poland’s familiarity and spent almost two grueling years migrating to the United States. When they made it, they started from nearly zero and built a prosperous life (and learned a new language). His parents thought and acted differently than his schoolmates’ parents. Recognizing you’re in the wrong situation, taking action to get to the right situation, and successfully rebuilding from zero highlights the immigrant mentality ingrained in Sam’s parents.

That mentality was the reason Sam’s parents weren’t killed by the Nazis, and they instilled that mindset in their children. Sam’s comfort in going against conventional wisdom, ability to repeatedly change strategies, and dogged work ethic resulted from being raised by parents who embraced the immigrant mentality.

How Did Sam Become So Successful?

Sam embraced capital leverage throughout his career. He often used two forms of capital leverage simultaneously. He borrowed from banks and raised money from investors to purchase investments, which is common in real estate. When he invested using leverage, he could invest in opportunities that exceeded the capacity of his capital and magnified the returns when deals were successful. Conversely, leverage magnified painful periods for him.

Sam also invested when the prices were so low that his downside risk was significantly reduced while his upside potential was massive. For example, in real estate, he purchased when properties were selling below replacement cost, meaning that any new competitors would be forced to charge higher rental rates than Sam.

Buying at the bottom and using capital leverage significantly reduced his probability of being crushed by leverage and magnified his gains.

Sam was a macro thinker. He could understand the implications of a macro change, such as a new law, and what micro actions to take to capitalize on it. Thinking top-down and being right about micro implications is extremely difficult, and executing on such understanding consistently is extremely difficult and rare. Sam had this gift and drew on it to invest in more than just real estate.

Sam recognized the value of having access to liquidity when using capital leverage in the business. He understood that the stock market is the only reliable source of liquidity. Even when times are tough, people are still buying and selling in the market. Sam spent time mastering the IPO process and learning how to run a company in a manner that met public-market investor expectations.

What Kind of Entrepreneur Was Sam?

Sam was an entrepreneur, not a founder. He wasn’t focused on a specific problem or solution. He was always looking for an opportunity to make money. Finding creative and intellectually stimulating ways to make money excited him. He had no interest in focusing intensely on a single problem for an extended period.

Sam enjoyed the art of deal-making, although he doesn’t appear to have been a zero-sum thinker. He wanted everyone to win so he could do more deals with them in the future and not take every penny for himself.

Sam was a high-level strategic thinker. Operational details didn’t interest him at all. He understood this and leaned into it. He was at his best when partnered with someone operationally minded, such as Bob Lurie.

What Did I Learn from Sam’s Journey?

The immigrant mentality is a powerful force and can change one’s life trajectory. This mindset comes with risks, but if consistently applied, it will likely put you in a better situation.

Being driven and intense exacted a price. Sam was married three times.

Thinking in terms of supply and demand is a simple way of evaluating opportunities. There’s no substitute for limited competition. Thinking about when supply and demand curves will intersect and the opportunity that will be created stuck with me.

Risk evaluation—constantly evaluating the downside and upside of every situation and acting only when downside is limited—is something to keep top of mind.

Simple tools can have a big impact. Sam used outlines to organize his thinking and cut to the heart of complex issues. When he was in trouble, he made lists and zeroed in on the tasks to accomplish each item on his list. This helped him from being overwhelmed.

Capital leverage make it difficult and stressful to weather the inevitable rough periods in the business cycle. When you’re at the top of a cycle, upside potential is reduced and downside risk increases. This is a great time to reduce or eliminate your capital leverage.

Finally, Sam was eccentric and did things his way, but he did everything at a high level and to the best of his ability. Because he did everything at a high level, he won more than he lost. Because he won more than he lost, people embraced his eccentricity. If you’re excellent at what you do, people will accept you for who you are, regardless. Everybody loves a winner!

Sam was an amazing entrepreneur. In his autobiography, Sam provided specific details on some of his biggest deals. Anyone interested in buying companies, entering new businesses, or using frameworks when investing can benefit from reading his book.

Prefer listening? Catch audio versions of these blog posts, with more context added, on Apple Podcasts here or Spotify here!